Armenian finance minister: SMEs’ tax burden to be eased

12.06.2014,

17:27

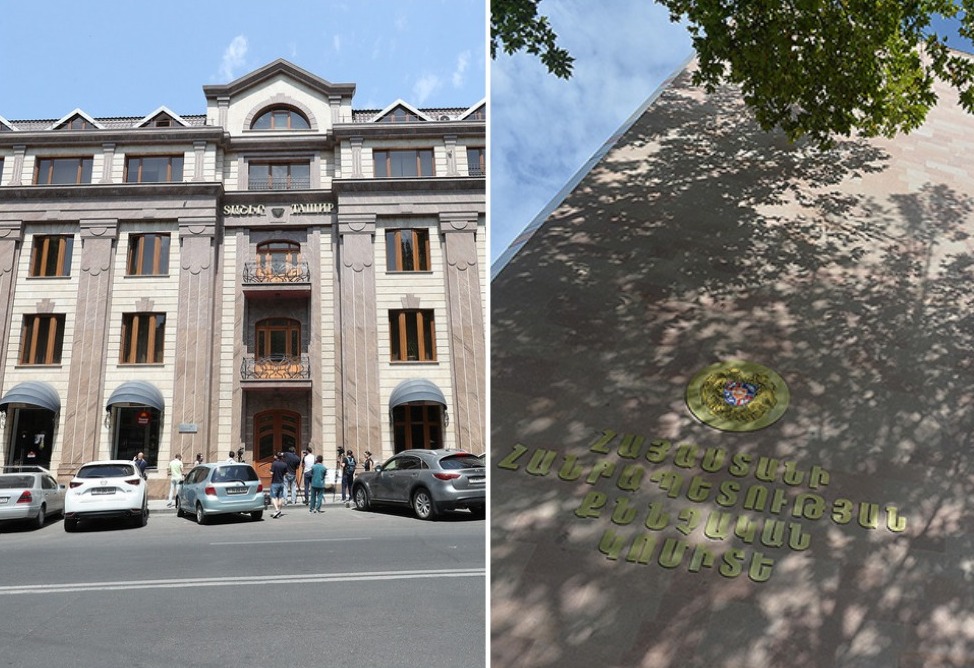

Armenia’s government approved today amendments to the turnover tax law and also a package of six other laws designed to create more favorable tax environment for companies engaged in trade and small and medium family businesses.

YEREVAN, June 12. /ARKA/. Armenia’s government approved today amendments to the turnover tax law and also a package of six other laws designed to create more favorable tax environment for companies engaged in trade and small and medium family businesses.

Finance Minister Gagik Khachatryan said that turnover tax rate for economic entities is planned to be lowered from 3.5% to 1% on October 1, 2014.

The family business status is planned to be introduced as well. It means economic entities whose business is registered as family business and whose annual turnover doesn’t exceed AMD 12 million well be exempted from taxes, but those entities making fixed and licensed payments are not allowed to shift to family businesses.

“It is planned to make paperwork a necessary requirement for SMEs on October 1, 2014,” Khachatryan said.

The minister said offenders will be warned only once, the second case carries imposition of AMD 20,000 fine, the third case will be followed by levying 5% turnover tax tallied from the beginning of the year and the fourth offence will force the wrongdoer to pay VAT.

It means those SMEs having no proper papers will pay five percent higher tax and if they continue defying the rule they will be paying VAT.

Khachatryan said that this implies small and mid-scale businesses’ automatic transition to “white field” with submission of necessary papers to the tax agency.

Supervision mechanisms will be tightened and penalties for offences will be specified.

Prime Minister Hovik Abrahamyan instructed the finance minister to do whatever necessary to force large businessmen to pay their taxes.

“We will achieve success if take consistent steps! We are taking an important step to help SMEs in their efforts to accomplish!” --0----