Armenian car insurers’ bureau intends to solve traffic jam problems caused by mandatory car insurance formalities on roads

03.02.2016,

11:42

The Bureau of Car Insurers of Armenia intends to solve traffic jam problems caused by mandatory car insurance formalities on roads, Vahan Avetisyan, executive director of the Car Insurers Bureau, said Tuesday at a news conference summarizing the results of the first five years of obligatory car insurance in the country.

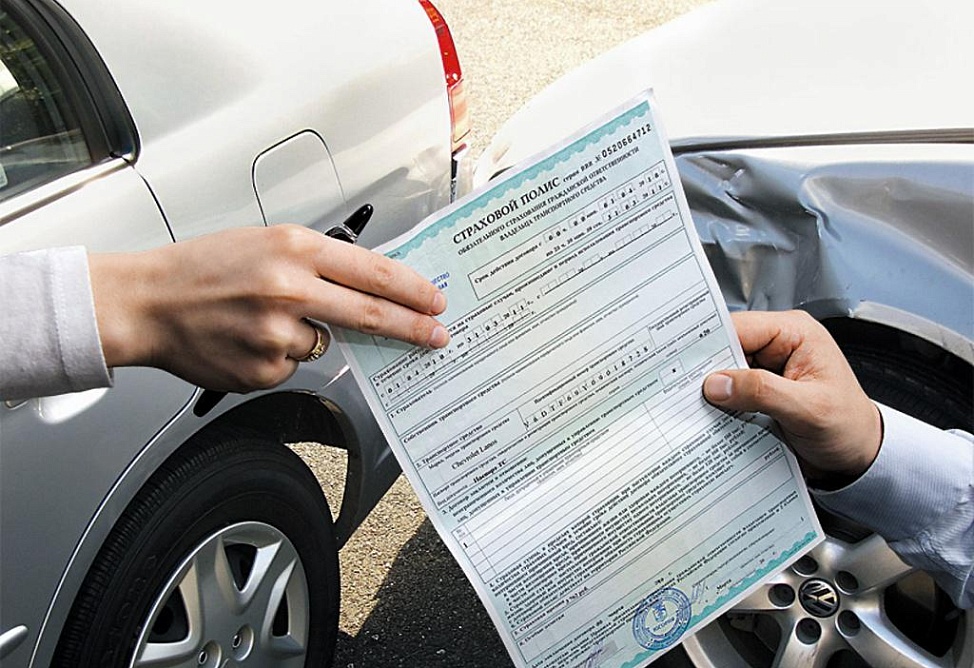

YEREVAN, February 3. /ARKA/. The Bureau of Car Insurers of Armenia intends to solve traffic jam problems caused by obligatory motor insurance formalities on roads, Vahan Avetisyan, executive director of the Car Insurers Bureau, said Tuesday at a news conference summarizing the results of the first five years of obligatory car insurance in the country.

He said that both achievements and faults have been recorded since mandatory car insurance was instituted in Armenia in 2011.

Avetistan pointed out traffic jams as one of these faults saying that traffic jams emerge mainly by presence of concerned persons, including policemen and insurance companies’ officers, on the scene of the accident.

“Formalities took much time and create traffic jams,” he said. “In accordance with preliminary arrangements with the Central Bank of Armenia and the police, we propose to concentrate all the instruments necessary for registration of traffic accidents and regulation of traffic jams in the traffic police’s hands.”

Avetisyan, however, stressed that this innovation doesn’t apply to participants of the independent damage regulation system, which will be introduced in the country in February 2016.

He added that the new system will also contribute to solution of the jam problem saying that the system implies independent registration by persons involved in traffic accidents with property compensation claims up to AMD 50,000.

As a rule, accidents with property compensation claims up to AMD 50,000 make up about 20% of the total number of traffic accidents.

He pointed out figures on car accidents as example – 2,000 car crashes, on average, had been recorded every year before obligatory car insurance introduction, while after the introduction, the annual average number of crashes is reported at 4,045.

“This means that the number of unreported, ‘shady’ traffic accidents was 20 times greater than the reported cases,” he said.

The number of insured cars has grown from 390,457 in 2011, when mandatory car insurance was introduced in Armenia, to 457,878 in 2015, ($1 – AMD 489.16). ---0---

He said that both achievements and faults have been recorded since mandatory car insurance was instituted in Armenia in 2011.

Avetistan pointed out traffic jams as one of these faults saying that traffic jams emerge mainly by presence of concerned persons, including policemen and insurance companies’ officers, on the scene of the accident.

“Formalities took much time and create traffic jams,” he said. “In accordance with preliminary arrangements with the Central Bank of Armenia and the police, we propose to concentrate all the instruments necessary for registration of traffic accidents and regulation of traffic jams in the traffic police’s hands.”

Avetisyan, however, stressed that this innovation doesn’t apply to participants of the independent damage regulation system, which will be introduced in the country in February 2016.

He added that the new system will also contribute to solution of the jam problem saying that the system implies independent registration by persons involved in traffic accidents with property compensation claims up to AMD 50,000.

As a rule, accidents with property compensation claims up to AMD 50,000 make up about 20% of the total number of traffic accidents.

He pointed out figures on car accidents as example – 2,000 car crashes, on average, had been recorded every year before obligatory car insurance introduction, while after the introduction, the annual average number of crashes is reported at 4,045.

“This means that the number of unreported, ‘shady’ traffic accidents was 20 times greater than the reported cases,” he said.

The number of insured cars has grown from 390,457 in 2011, when mandatory car insurance was introduced in Armenia, to 457,878 in 2015, ($1 – AMD 489.16). ---0---