What is a risk profile and how it relates to investment strategy

YEREVAN, April 23./ARKA/. Before engaging in transactions in the financial market, an investor should develop an action plan. At this stage, not only the accuracy of calculations but also modeling is important. In other words, it is necessary to fantasize!

Imagine, for example, that you have invested in securities and within three months the total value of your portfolio has fallen by 25% and your capital has been reduced by 4 times. What would you do?

Sell all the assets and deposit the money?

Invest these funds in less risky instruments?

Will you not panic and leave everything unchanged, because after some time the capital will recover?

Or maybe wait for assets to get cheaper so you can invest more to expand your portfolio?

The proposed "task" is a standard part of the risk profile test. It is a "portrait" of an investor, reflecting his/her attitude to financial risks. Thanks to it, you will be able to choose the most effective strategy for yourself in the market.

Most risk profile tests contain these blocks of questions:

- age

- current financial situation

- amount you intend to invest

- responsibility for other people from a financial point of view

- characteristics of your financial goals (expected investment period, desired return)

- risk perception

- acceptable losses

- knowledge and experience in investing

The investor's answers form his/her holistic portrait, which makes the approach to portfolio formation more informed.

Potential profitability and riskiness of instruments vary: higher profitability - more threats. Let us describe the main assets based on this principle.

Bonds are debt securities with guaranteed and predictable yields. The terms and amount of payments are fixed by the contract and are known in advance. The main risk associated with bonds is bankruptcy of the issuer. However, if you buy government securities or those of large companies, the risks become minimal.

Mutual funds and ETFs. The principle of mutual funds is based on the distribution of shares in the portfolio among many investors. The assets are selected and their composition is updated by the management company. ETFs are exchange-traded funds that are invested in various instruments based on an index. By buying a share, you are investing in all assets at once.

We consider these instruments together because of similar operating principles and risks. In both cases there is no guaranteed and insured return. That is, in case of bankruptcy, investors will lose their funds. In addition, there is likely to be a decrease in demand for the products of the sector in which the mutual funds acquire assets, introduction of new bills and sanctions..

Shares are potentially the most profitable instrument among the above mentioned. However, it is also risky, because if the issuer goes bankrupt (due to general crises, problems in specific industries, wrong actions of the management), the holders of shares may lose money.

The dividend approach is considered conservative if one chooses securities of a reliable issuer: "blue chips" or companies that demonstrate strong financial performance but are underestimated by the market. Their shares are called value shares, because they will potentially rise in price and bring profit.

Another approach is to buy securities of promising companies. The strategy is well suited to people who are focused on long-term investments and are ready to react calmly to the moments of recessions. Such an instrument is called growth stocks.

The most specific and risky are transactions with currencies and derivatives (futures and options). In case of unsuccessful transactions with "credit leverage", you can not only lose your own funds, but also remain in debt to the broker.

Each investor has a different risk profile

There are three main types of investors according to their risk profile: conservative, moderate, aggressive. The classification can be detailed by adding intermediate levels. We will focus on the largest blocks in order to describe the differences between risk profiles and the indicators that define them.

Psychological makeup

A conservative investor is highly stressed by losses and seeks predictability and control. The aggressive one on the contrary, is ready for risk and losses, takes independent active steps. A moderate investor tolerates minor threats for the sake of potential profitability and is ready to learn new financial instruments.

Expected return

A conservative investor is interested in saving money, protecting it from inflation and receiving a low but guaranteed additional income - from 5 to 15%. Moderate strategy allows to increase capital by 20% in the long term. An aggressive investor aims for the highest possible profit.

Investment objectives and timeframe

There is a principle in the market: the shorter the investment period, the more conservative the composition of the portfolio should be. This is because risky instruments are subject to sharp fluctuations in price.

For example, if you definitely need money in a year, it is not safe to invest everything in stocks, because it is impossible to guarantee their profitability in such a short period of time. However, an aggressive investor in a situation when you need to earn a lot and quickly, is likely to make transactions with risky securities or currencies. These instruments are the most profitable.

Age and planning horizon

From the perspective of young investors who are planning more than a decade ahead and do not need to raise funds as soon as possible, an aggressive approach is justified. First, there is enough time to recover capital in the event of an unsuccessful investment. Second, over the long term, returns on aggressive instruments grow, offsetting drawdowns and outpacing inflation.

Older investors usually invest with the goal of earning additional income for retirement in the coming years. They seek to avoid the risk of any losses and invest in instruments with not the highest but guaranteed returns.

Qualifications

An investor with knowledge and transaction experience is more prepared for an aggressive strategy than a novice. However, he/she may reject risky instruments if they do not suit his goals, vision and character. At the same time, an inexperienced participant will not always start by looking for large issuers and buying a stake in a fund. If he/she does not seek to increase capital in the shortest possible time, and losses will not critically affect their life, they can actively invest in growth stocks and assets of promising industries.

In addition, private investors with a special status of qualified participants work on the stock market. Having met a number of criteria (experience, certain asset value, education, etc.), they receive confirmation from the regulator and access to a wide range of instruments, including the most profitable and risky ones.

Characteristic financial instruments

Conservative approach: government bonds and highly reliable companies (approximately 70% of the portfolio), blue chip stocks, ETFs.

Moderate approach: one half of the assets are in safe bonds, the other half in equities and ETFs.

Aggressive investing: the majority of investments (approximately 80%) are in stock market instruments, including high-risk ones: securities of companies from technological and developing industries. It is also possible to work with derivatives on the derivatives market, Forex transactions and leveraged trading.

When compiling a risk profile, you should remember that it is a dynamic indicator that helps you to define your strategy in a certain period of your life. Financial goals and opportunities change over time. Therefore, your risk profile and investment approach should be regularly evaluated and adjusted.

Summary

A risk profile is a portrait of an investor reflecting his or her attitude to risk.

It consists of personal qualities, financial goals and opportunities, life and professional experience.

Needed to create a strategy suitable for a particular investor.

How it works: the higher the potential profitability of an instrument, the greater the risks associated with it. Having determined his/her readiness for losses, desire and necessity to take risks, the investor will choose more effective assets for himself/herself.

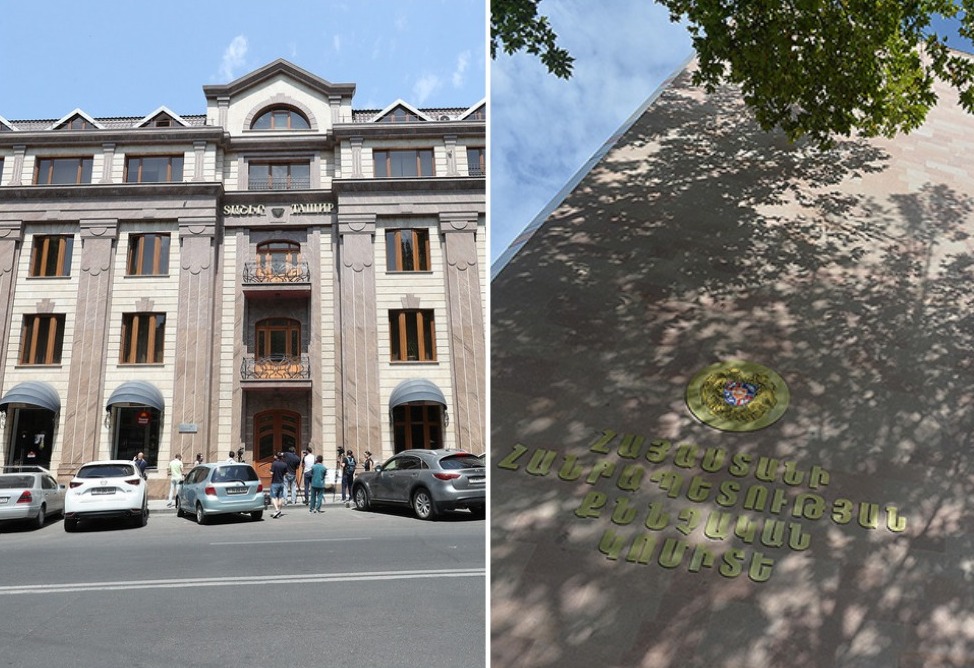

This material is prepared within the framework of the joint project "The Year of Investing in Oneself" by ARKA, AMI Novosti-Armenia news agencies and Freedom Broker Armenia.